vermont sales tax on alcohol

The Vermonts state tax rate varies depending of the type of purchase. 6 Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption contain one-half of.

Sales Tax On Grocery Items Taxjar

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants.

. Sales tax is destination-based meaning the tax is applied based on. Vermonts general sales tax of 6 also applies to the purchase of beer. If a receipt is not itemized delivery charges are taxed at the highest rate of the alcohol tax instead.

However local sales taxes can increase the total to 90625. Taxes on spirits are significantly higher than beer and wine at 1350. 138 In.

General Purpose Clear Grease. Chain Drive Lubricant. Vermont Beer Tax - 026 gallon.

All alcoholic beverages are subject to sales taxes. What is the alcohol tax in Vermont. The meals and rooms tax is imposed on the sale of all alcoholic beverages malt beverages vinous beverages spirits and fortified wines sold for immediate consumption.

The state tax is 5125. According to a release from the. Are excise taxes included in the Vermont sales tax basis.

For beverages sold by holders of 1st or 3rd class liquor licenses. Meals - 9 alcohol - 10 general goods - 6 rooms. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

Excise taxes are separate levies added by many states to the price of commodity items such as alcohol gasoline etc. Effective June 1 1989. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law.

In addition the state imposes a gross receips tax on. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. The federal government collects approximately 1 billion per month from excise alcohol taxes on spirits beer and wine.

The average combined tax rate is 618 ranking 36th in the US. Are groceries taxed in Vermont. This bill takes important steps forward to modernize our liquor laws and support economic growth Scott said about signing the legislation.

9241c Alcoholic beverages sold for immediate consumption by a bar or restaurant. Are served for immediate consumption are subject to the 10 Vermont Alcoholic Beverage Tax. The tax rate is.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1There are a total of 153 local tax jurisdictions across the state collecting an. Pure Isoproyl Alcohol Solvent. Are groceries taxed in Vermont.

How much is sales tax on a car in. In Vermont beer vendors are responsible for paying a state excise tax of 026 per. If the alcohol is being delivered the delivery fee is part of the meal price and is also taxable.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. 10 Alcoholic Beverage Tax 32 VSA. Alcoholic Beverage Sales Tax.

1 Local Option Tax 24 VSA.

Vermont Managing Sales Tax Exemptions In The Agriculture Industry Avalara

Vermont Cigarette And Tobacco Taxes For 2022

Sales Taxes In The United States Wikipedia

Iowa S Spirits Excise Tax Is Among The Highest In The U S Distilled Opinion

Vermont Gold Vodka Prices Stores Tasting Notes Market Data

Beer Map How High Are Beer Taxes In Your State State Beer Map

/cloudfront-us-east-1.images.arcpublishing.com/gray/K4E7H5TTOVHQDHNSHPWU7GKDCM.jpg)

Vermont Nh Alcohol Sales Continue With Pandemic Bump

Vermont Sales Tax Calculator Reverse Sales Dremployee

Are Vermonters Paying The State S Mandatory Use Tax Spoiler Nope Economy Seven Days Vermont S Independent Voice

Historical Vermont Tax Policy Information Ballotpedia

Form Mrt 441 Meals And Rooms Tax Return Vermont Tax Vermont Fill Out Sign Online Dochub

A Toast To Utah Liquor Dollars They Topped A Half Billion For First Time

Beverage Warehouse Vermont S Largest Craft Beer Wine Liquor Store

Vermont Cigarette And Tobacco Taxes For 2022

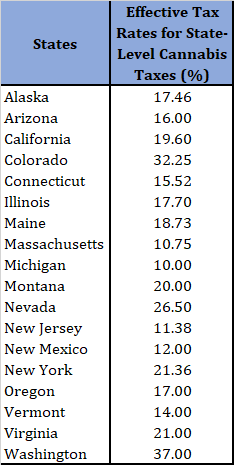

Assessing State Level Adult Use Cannabis Taxation Aaf

Boyden Valley Winery Vermont Ice Maple Cream Liquer Vermont Prices Stores Tasting Notes Market Data

Vermont Income Tax Vt State Tax Calculator Community Tax

Caledonia Spirits Barr Hill Gin 750 Ml Bottle

New Vermont Law Lowers Tax On Ready To Drink Cocktails Expands Sales Vermont Thecentersquare Com